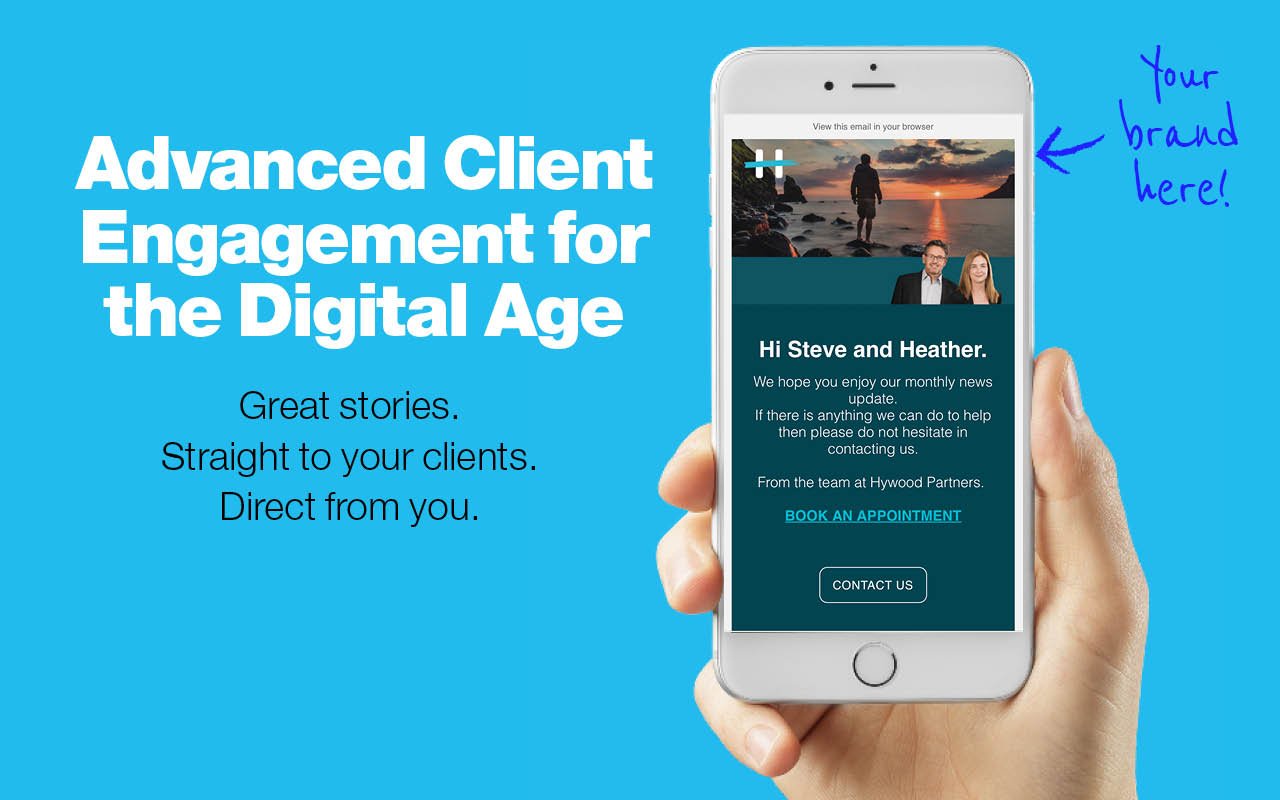

Great stories.

Straight to your clients.

Direct from you.

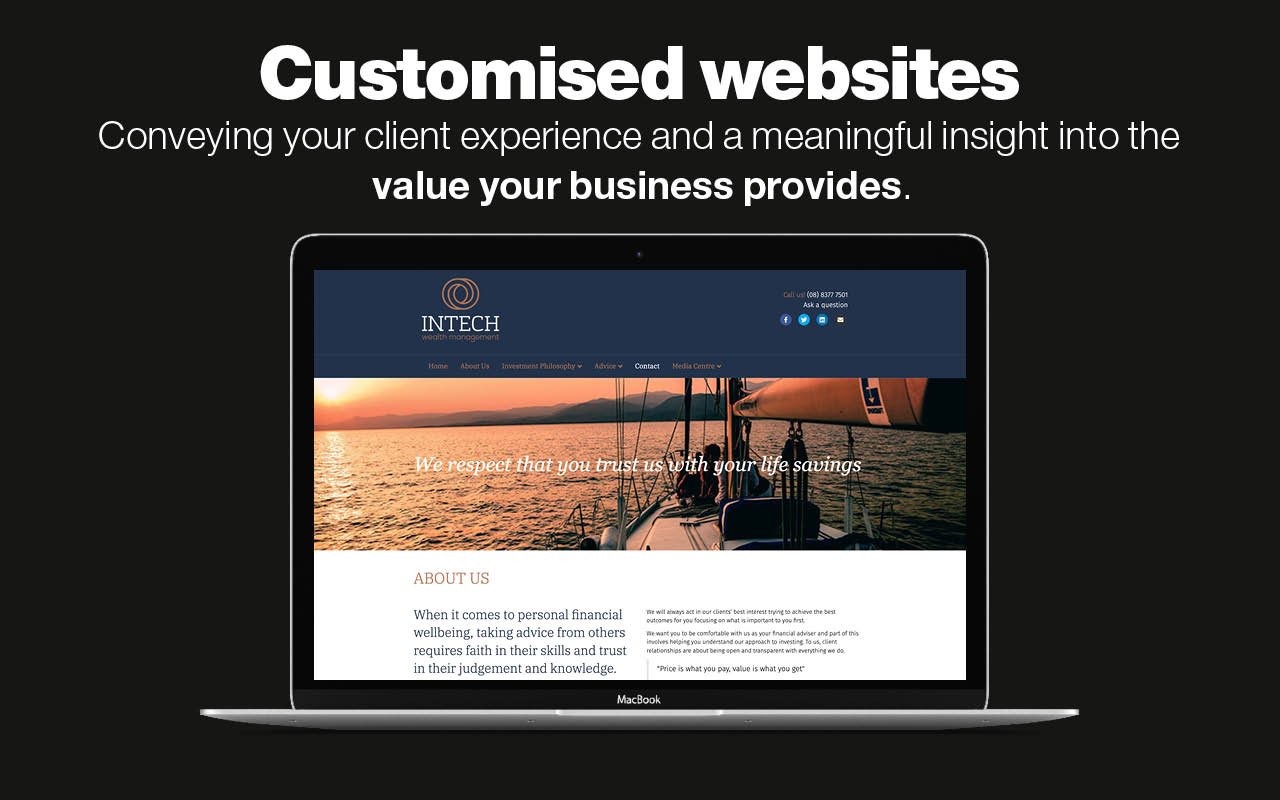

Bringing together customised website solutions and client engagement.

For more information on submitting content requests see FeedsyExclusive and FeedsyWrite

Marketing for small business made easy

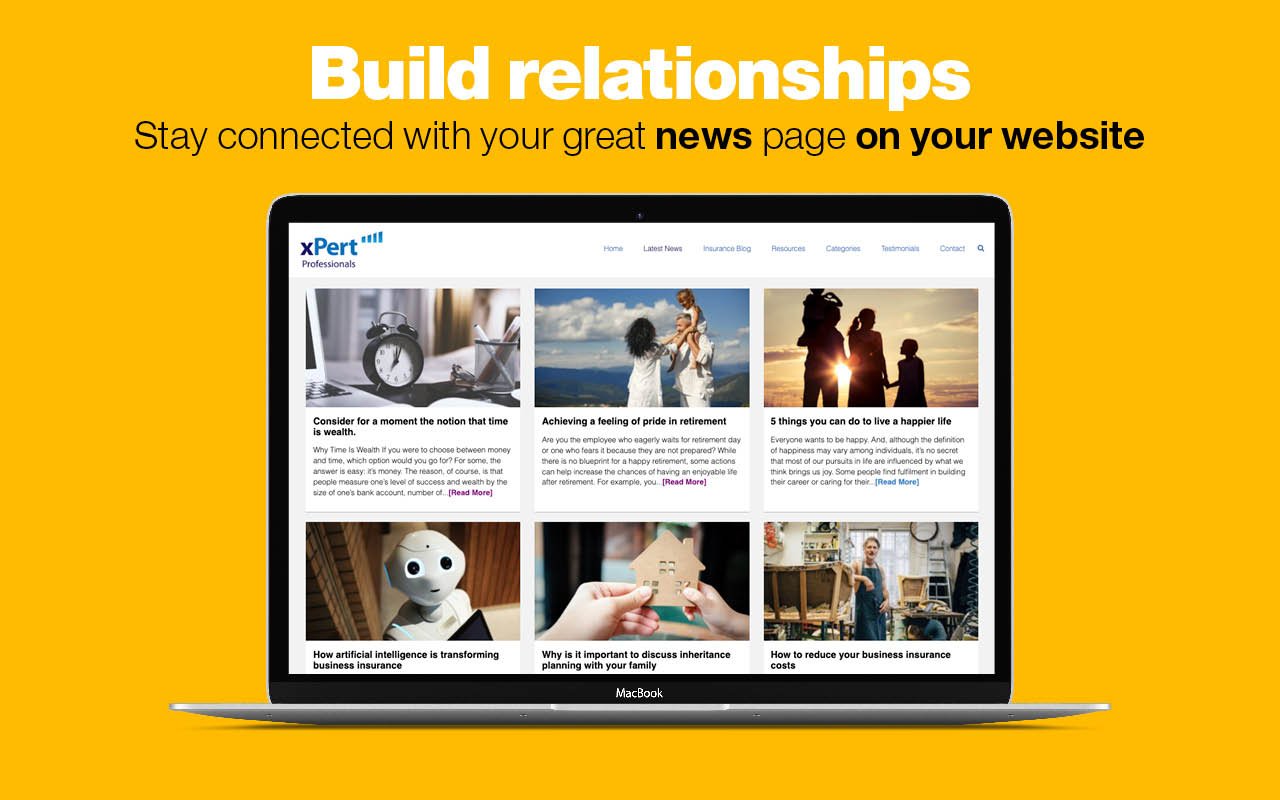

For over ten years now, business owners have been saying that Feedsy “gives me this confidence that I've got marketing under control” and that “Feedsy is my client engagement platform, and it saves me time”. It is a well-known fact that regularly staying in touch with clients increases client retention.

Feedsy brings together digital content services and website development that empowers business owners to be in control of their client experience.

An all-in-one digital client engagement solution, solving pain points such as automated newsletters, client segmentation, content requirements, social media function, referrals, client feedback and website development.

Branded client communications

Feedsy helps small businesses (like you) connect with clients by implementing various Engagement Plans of fully integrated digital communication solutions.

Looking beyond that, feeding value back from the customer to the business owner is where the magic happens... bringing back amazing Net Promoter Scores, bringing back Google reviews, bringing back testimonials, bringing back referral opportunities.

Over the last decade, Feedsy has evolved into what business owners really need: two-way communication with clients.

Each of our Engagement Plans is totally branded as you including news web pages linked to email newsletters. If creating stories seems a bit daunting, Feedsy can source great content on your behalf to share on your Feedsy channels and social media.

That’s great news for you AND your clients.

Do you have a question or want to speak to someone? We are here to help.